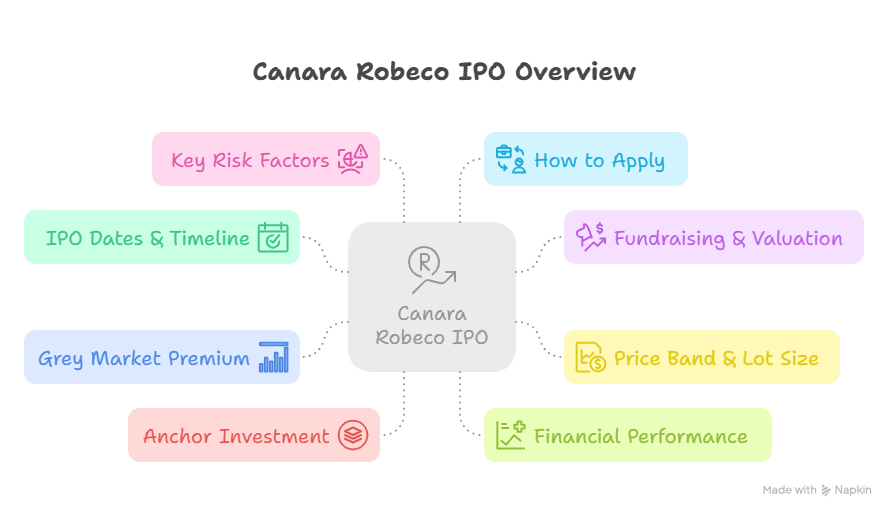

Upcoming Canara Robeco IPO: Dates, Price Band & Fundraising Info for All Investors

The initial public offering (IPO) investment market is prepared to welcome a new player in the town as Canara Robeco Asset Management Company. has officially filed its draft papers with SEBI, marking the first step toward its much-anticipated initial public offering. Here’s everything you need to know about this upcoming market debut.

IPO Dates & Timeline

- The offerings of Canara Robeco are expected to hit the markets in December 2025.

- The subscription window is highly likely to open from December 15-17, 2025.

- The listing date is tentatively set for September 25, 2024, though these dates await final confirmation from SEBI and the company.

Fundraising & Valuation

- The IPO of Canara Robeco is planning to raise approximately ₹2,000-₹2,500 crore

- The company is looking for a valuation of around ₹15,000 crore.

- This makes it one of the most significant offerings in the Indian asset management space this year.

Price Band & Lot Size

- The price band for the Canara Robeco IPO is anticipated to be in between ₹253-266 per share.

- The lot size is set for 56 shares per application.

- The minimum investment for all retail investors would be around ₹24,000-₹26,000 per application.

- The total issue size of the Canara Robeco IPO is set to 4,98,54,357 shares (totalling up to ₹1,326.13 Cr).

Grey Market Premium (GMP) of Canara Robeco IPO

Current activity of the grey market is pinpointing to a premium of ₹5 per share for Canara RObeco IPO. This indicates slight interest of the investors and potential listing gains. The GMP of the IPO has been stable in this particular number since the DRHP filing.

Anchor Investment

Canara Robeco company has reserved around 30% of the offering for its anchor investors. with several domestic mutual funds and foreign institutional investors already showing keen interest in participating for this specific IPO.

Financial Performance

Canara Robeco has showcased consistent growth, with Assets Under Management (AUM) for FY24 (Financial Year 2024) was ₹77,217.36 crore. The company’s revenue for FY24 stood at ₹318.78 crore, with a net profit of ₹150.87 crore.

Key Risk Factors

All the interested Investors like you need to keep note of the company’s dependence on market performance for its management fees and the competitive nature of the asset management industry. Still, the strong background and steady (positive) track record minimizes these risks.

How to Apply

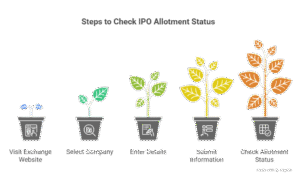

Investors can apply through their ASBA-enabled bank accounts or demat account platforms. The allotment status is expected to be finalized on September 20, 2024. If the shares are not allotted to anyone, the blocked amount will be unblocked and refunded back to their bank account.

As the Indian mutual fund industry is gradually showing significant growth in just a few years and increasing retail participation, Canara Robeco’s IPO can turn out as an opportunity for investors. They can participate in the IPO for a well-established asset management company with strong fundamentals and growth prospects.