LG Electronics IPO is Around the Corner: Check Out Opening Date, GMP, & Other Critical Information

Fasten your seatbelts, dear investors! LG Electronics India, the brand behind numerous high-quality refrigerators, TVs, and washing machines, is planning its market debut with an initial public offering (IPO). While the company is putting the final touches on its plan, LG Electronics IPO is one of the most anticipated initial public offerings on the horizon.

Opening Date & Timeline of LG Electronics IPO

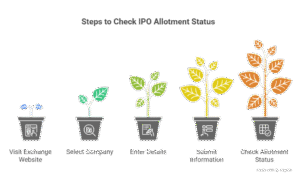

The IPO will hit the Indian share market on 7th of October, 2025 for subscription and closes on 9th of October, 2025. The allotment is expected to finalize on the 10th of October, 2025, listing on both NSE and BSE.

GMP (Grey Market Premium) of LG Electronics IPO

Shares of LG Electronics India are currently available in the grey market with a good GMP (The Grey Market Premium (GMP) is the unofficial indicator of investor excitement, and for LG, it’s buzzing!). The shares are being traded in the grey market ahead of its IPO launch date, reflecting strong demand and positive sentiments of the shareholders in the market. The GMP of LG Electronics IPO is ₹146 as of today (04-October-2025).

Price Band of LG Electronics IPO

The actual price band of LG Electronics IPO is set in between ₹1080.00 to ₹1140.00 per share.

- The lot size for one application is 13 and the minimum investment required from each retailer is ₹14,820.

- On the other hand, the lot size investment is set to 14 lots (182 shares) for sNII (Small Non-Institutional Investors) and the minimum investment is for ₹207,480.

LG is planning to raise ₹11,607.01 crore funds through the initial public offering in the Indian stock market. It will be completely an offer for sale (OFS). This means that no fresh issue of the shares will be introduced. Instead of issuing new shares, the promoters and existing owners will sell part of their stake, opening the door for investors to take part in a large IPO.

The IPO of LG Electronics is valued at ₹77,380.05 crore. By March 31, 2025, the company had a PAT margin of 8.95%, an EBITDA margin of about 12.75%, and a price-to-book ratio a little over 13. The company has shown consistent growth in both revenue and profit over the past three years. With these strong fundamentals, the IPO is going to draw significant interest from investors across India.